CHAMPAGNE FIZZES AS CONSUMPTION RISES ABOVE 2019 LEVELS

While Champagne has had a bit of a rollercoaster ride during the pandemic, the category has been largely resilient and new data from drinks analyst IWSR says that it has recovered to just above 2019 levels. The London-based group said: “Momentum continued through 2021, with global Champagne consumption growing by over 20% in 2021.”

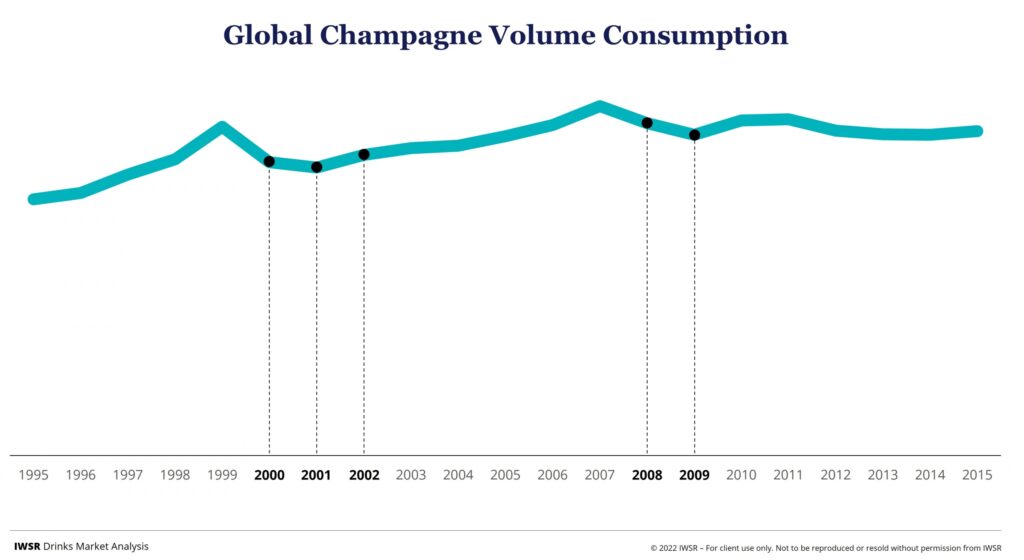

Traditionally, tough economic and geopolitical times have led to downturns for the sparkling wine category as the chart below shows. For example, the recessions of the early 2000s coupled with 9/11 and then the global financial crisis in 2008-09 both led to declines in sparkling wine sales, particularly for Champagne. These periods did not easily lend themselves to celebratory activities.

It was a similar story during Covid-19. Early on in the pandemic the US market saw a slide in the performance of bubbly partly as a result of stockpiling but mainly from the impact of bars and restaurants being forced to close there, and around the world. However, a quicker-than-expected rebound began in the second half of 2020 causing supply chain bottlenecks for Christmas 2020 and that build-back has continued.

Younger buyers are now a big market

In the US, Wine Intelligence profiling data for 2021 show that, for the first time, the proportion of sparkling wine drinkers who were under 40 reached 50% of the total sparkling wine drinking population. That is a market of 25 million out of 50 million drinkers according to the research and insights group. This is a bigger proportion than still wine drinkers where Millennial and Gen-Z drinkers have fallen to less than a 30% share.

One factor for the appeal is that sparkling wines, Prosecco and Champagnes are perceived as a less complex, more universal choice than the selection of still wines which require more knowledge making them a more intimidating purchase. Sparkling, by its bubbly and fizzy nature, is also seen as more accessible and fun according to consumer research – and suitable for a wider variety of occasions.

Recent moves by the big houses have also encouraged younger participation. Last year, France’s luxury goods giant LVMH took a 50% stake in singer Jay-Z’s ‘Ace of Spades’ Armand de Brignac Champagne, while Prosecco’s governing body – Prosecco DOC Consortium – gave the green light for the production of rosé Prosecco in 2020 which will build on rosé’s widening appeal.

New launches show confidence

Despite the broader target, the market for high-end Champagne remains solid and niche. Underlining its faith in a post-pandemic resurgence of fine drinking and dining, Maison Perrier-Jouët recently unveiled the latest vintage of its most emblematic line: Belle Epoque Blanc de Blancs 2012, a 100% Chardonnay Champagne.

The global launch of the limited-quantity line took place in London at the end of May at Sketch, one of just five restaurants in the city to carry three Michelin stars. Perrier-Jouët Belle Epoque Blanc de Blancs 2012 is described as “a wine for gastronomy” and has gone into selected markets worldwide.

Meanwhile, taking advantage of the interest in rosé, Champagne Lanson has also unveiled something new for 2022: Le Rosé Fruit Market, a limited edition in a box that targets travellers at airports wanting to give a gift.

The presentation box echoes the fruits that are revealed during a tasting of the liquid and the product is marketed as “perfect for sharing on a summer’s day”, underpinned by two high-profile promotions. From 31 May to 27 June, Lanson has a pop-up at Paris Charles de Gaulle Airport where red fruits food pairings will be offered to passengers as part of a so-called ‘bistronomie’ concept. And from 1 June to 31 July a special ‘event bar’ at Frankfurt Airport will also have tastings.

Edouard de Boissieu, head of travel retail at Champagne Lanson said: “We know from first-hand experience how important and effective promotions such as this can be and we are very grateful to our retail partners for giving us this opportunity.”

These launches mark the price and product diversity of the Champagne category. What they have in common, however, is the expectation of a return to in-person social occasions despite the spectre of higher inflation. For the time being, social events have taken on “a more celebratory and higher energy tone” says IWSR and the industry is hoping these occasions can withstand advancing economic headwinds.

Join us at SIAL Paris as exhibitor Join us at SIAL Paris as visitor

You Might Also Like:

Sign up to the SIAL newsletter and receive the latest news and all information about the next edition.