Agritech drives growth in European farming with £80bn investment

A new report by Govgrant has found that the UK and Europe are leading the way when it comes to agritech investment, having received nearly half of the £186bn global total.

This £186 billion of investment has come from just over 6000 different investors, according to GovGrant, a R&D tax specialist and IP patent box HMRC-led initiative.

Narrowing that down to Europe, the figure becomes about £80 billion from about 1,400 investors. Investment into UK companies stands at £866 million from 361 investors.

Investigating AgriTech companies that have received investment over 2000 to 2021, GovGrant found 1,773 companies globally in this space, with 474 headquartered in Europe. The UK lays claim to 90 of these companies and is the home to around 5% of such companies.

In terms of who is investing, the top five European investors were Innovate UK with 38 investments, Horizon 2020 with 31 investments, EIT Food with 26 investments, Enterprise Ireland with 15 investments, and Bpifrance with 14 investments.

In the UK top investors were Innovate UK (38, Scottish Enterprise (8), EIT Food (7), and Horizon 2020 (6). Eastern Agri-Tech Growth, ESA Business Incubation Centres and Seraphim Space Camp each invested in four companies.

Globally, the top investors were Horizon 2020, which invested in 41 companies, SVG Ventures-THRIVE, which also invested in 41, Innovate UK, National Science Foundation, and MassChallenge.

Although the UK makes up just a fraction of the total for investment, the government-backed Innovate UK is one of the top global investors, showing the UK does punch above its weight in the sector, GovGrant commented.

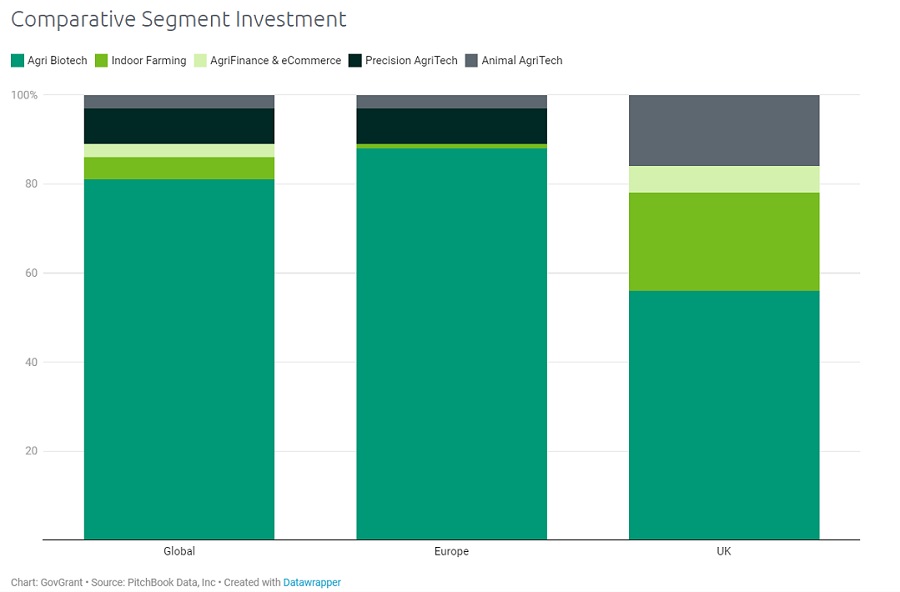

Breakdown of AgriTech investment by sector

- Agri Biotech (ABT) – creating inputs for crop and animal agriculture covering areas including genetics, microbiome, breeding, animal health, seed, and fertilizer.

- Indoor Farming (IF) – components, systems, growers focused on indoor farming. Including technologies addressing vertical farming, aquaponics, and hydroponics.

- AgriFinance & eCommerce (AFE) – provide financial services and marketplaces designed for agricultural companies and growers.

- Precision AgriTech (PAT) – provide software and sensors to monitor, analyse, predict and optimize crops, water, weather and pests in resource-efficient ways.

- Animal AgriTech (AAT) – developing technology solutions to monitor, analyse and optimize animal health and production, and even substitution through Alt Proteins.

As the above shows, Agri BioTech is the top segment for investment in all the geographical breakdowns, often by a considerable margin. However, the UK has a comparative specialisation in Indoor Farming and Animal AgriTech.

Together these account for almost 40% of UK investment in this sector, whereas globally or Europe-wide these are under 10%. This represents a growth and differentiation opportunity for the UK Agritech sector.

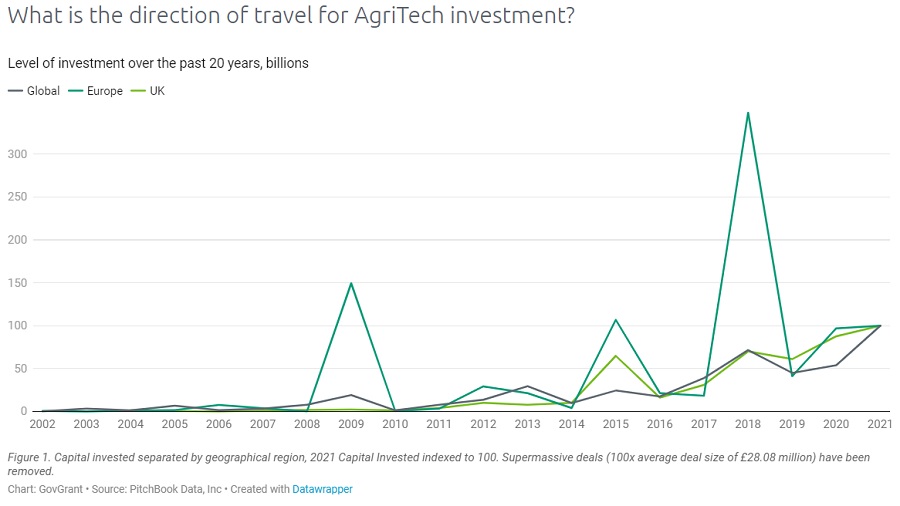

Looking at the graph above there is a clear increase in the level of investment over the period, that is present in all three geographical regions, GovGrant said. Globally there was over £14 billion of investment into AgriTech in 2021 alone.

Evidently investment levels have seen the largest increases in recent years, after having experienced very little change in investment levels pre-2011.

Researchers note that there are standout spikes in investment levels for Europe in 2009, 2015 and 2018, owing to specific M&A (mergers and acquisitions) activity.

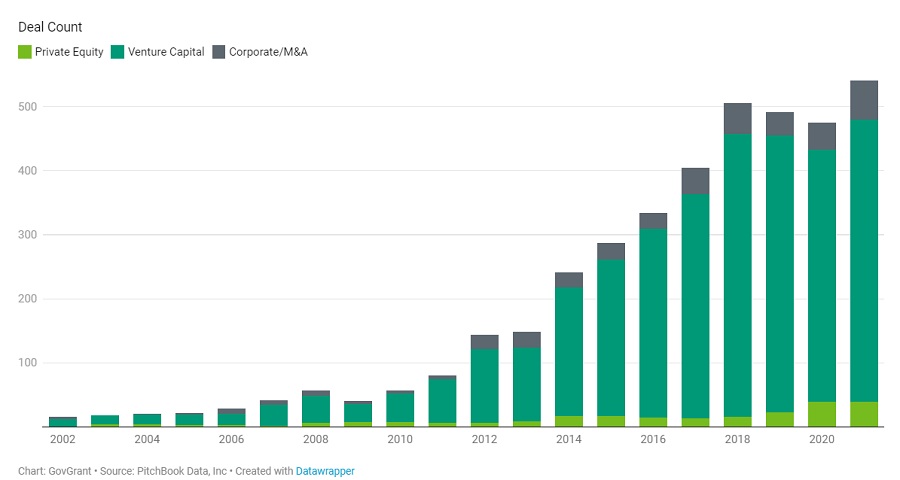

The graph above shows that the number of deals into AgriTech has increased significantly over the period, particularly in early-and-mid part of 2010s.

Unsurprisingly, GovGrant said, venture capital deals are the most numerous sources of funding for AgriTech businesses – funding almost 80% of all deals.

Private Equity and Corporate/M&A activity make up on average around 9% and 12% of all deals respectively.

What GovGrant’s research tells us about AgriTech investment

This research shows that globally, there is a large focus on Agri Biotech, claiming over 80% of all AgriTech investment. This segment has the potential to tackle some of the biggest issues associated with agriculture. For example, Pivot Bio is a developer of microbial nitrogen fertiliser intended to replace synthetic nitrogen fertiliser, one of the toughest challenges facing modern agriculture. They have raised over £500 million to date.

In the UK, there is a specialisation opportunity in Indoor Farming and Animal AgriTech. Just recently, London based Vertical Future, raised the largest series A ever for a European indoor farming company, at £21 million including participation from the likes of SFC Capital.

Lastly, overall investment into AgriTech is displaying an upwards trend with noticeable increases in recent years, the organisation said. This is a trend that is expected to continue as the world tackles the growing food demand as well as trying to abate greenhouse gas emissions associated with food production.

Venture capital is expected to continue to make up the bulk of these deals, as investors fund risky early-stage companies developing innovative technologies for a big pay-out, GovGrant went on. The successful companies will flow through to Private Equity investors and established industry players, such as Consumer Products sector acquiring players for growth & sustainability. GovGrant also expects an increasing number of public market debuts in this sector in coming years.

Join us at SIAL Paris as exhibitor Join us at SIAL Paris as visitor

Sign up to the SIAL newsletter and receive the latest news and all information about the next edition.