WINE INTELLIGENCE: BOOMERS AND GEN X ACCOUNT FOR 73% OF UK WINE DRINKERS

The latest UK consumer market research from Wine Intelligence (WI), a division of drinks analyst IWSR Group, suggests that older drinkers such as the boomer generation remain the key targets for the wine industry.

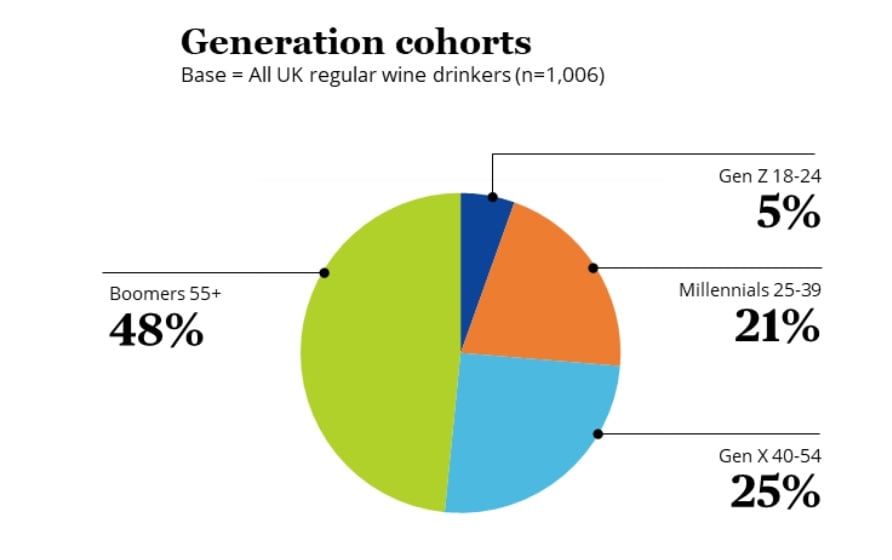

A presentation from Richard Halstead, the chief operating officer of Wine Intelligence at the London press conference for Wine Paris & Vinexpo Paris 2023, indicated that wine drinking was a lifestyle choice for Boomers (+55 years old) and Gen X (aged 40-54). They account for 48% and 25% of the market respectively (73% in total of the wine drinking population) with Millennials (aged 25-39) and Gen Z (aged 18-24) accounting for the rest at 21% and 5% respectively (percentages are rounded).

On the weak share for under 39s, Halstead said: “Today, alcohol is not a necessity it is an option. The generation that has come of age in the past five years has a very different relationship to alcohol compared to their parents. They still have alcohol occasions but they take them much more seriously rather than drinking alcohol just because it is there.” This latter point, and the curated way younger generations choose and drink wine, opens up some avenues for producers and retailers to target them.

Boomers and Gen X dominate off-premise

Boomers and Gen X are responsible for two-thirds of total spend in the off-premise market which includes supermarkets. In these environments, it is Gen X shoppers who are more experimental and willing to trade up as they tend to still seeking novelty, with almost half saying that they enjoy trying new and different styles of wine “on a regular basis”. Boomers, on the other hand, are much more set in their ways with 45% ticking ‘I know what I like and I tend to stick to what I know’ in the WI survey.

According to the report, called The Battle of Generations in the UK, routine purchase-patterns generally occur at entry and mid-price points. The report stated: “Boomers are heavily focused on informal wine drinking occasions. Younger legal drinking age consumers will have a more balanced repertoire of wine drinking occasions, and more of them in social settings.”

Winning over Gen Z and Millennials in the on-premise

Those social settings include pubs, restaurants, and wine bars where Gen Z and Millennials are open to trying premium and super-premium wines. While both generations only account for 26% of the regular wine drinking population they make up about 50% of total spend in the three on-promise locations just mentioned.

WI said: “For both of these cohorts, wine carries social values, prompting curiosity, involvement and higher spend levels.” While the youngest of the generations, Gen Z tend to be price sensitive as they are still paying off student debts and moving into the workplace, they are willing to trade up for social occasions.

These younger consumers “also show specific interest for sweeter styles of wines, rosé and sparkling” said the report, one reason why they are also more likely to drink sparkling wines, and sweet/dessert wines. For example, younger consumers are more likely to drink Moscato (a sweeter, fruity floral with a 20%+ share for the 18-39s vs 11% for Gen X and 4% for Boomers.

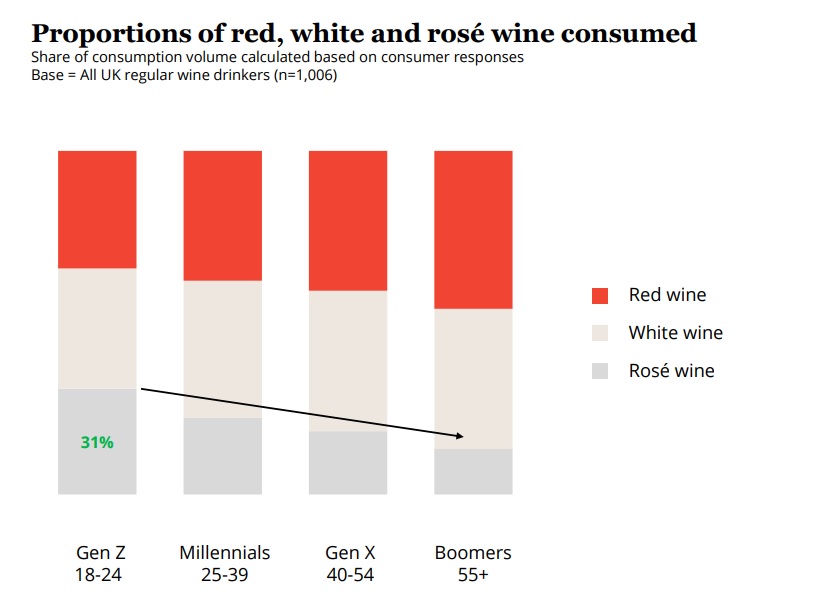

There is a definite skew to white and rosé wines as you move down the age groups, with some heavier red varieties such as Shiraz, being a turn off. WI said: “For red wines, it’s noteworthy that Shiraz penetration increases with age. Shiraz is the most generation sensitive red varietal: from 17% for Gen Z to 42% amongst Boomers.” And while rosé has been popularised across the board in recent years it is twice as popular with Gen Z wine drinkers as with the over 55s.

These drinking profiles and trading up possibilities are worth remembering in the retail environments of bars and pubs because generational wine drinking here is very different to the overall average we outlined at the top. In fact it works in reverse with penetration as follows: 82% for Gen Z, 69% for Millennials, 60% for Gen X and 52% for Boomers.

Join us at SIAL Paris as exhibitor Join us at SIAL Paris as visitor