How did 2022 pan out for the US spirits business?

A year ago, BevAlc Insights, the data arm of US online drinks platform Drizly, made some predictions for wine and spirits sales and consumer behaviours for 2022. So how many came true? Here’s a quick digest of how the market developed against the crystal ball gazing.

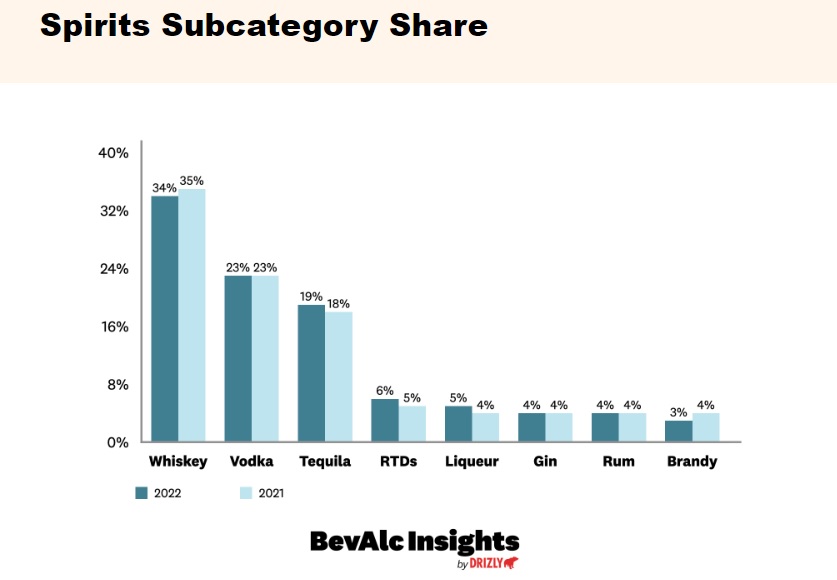

Firstly, from the data, it was evident that whisk(e)y retained the top spot as the best-selling liquor category on online platform, dropping a percentage point in share to 34% year-on-year. Vodka held steady at 23% in second place and while third-ranked tequila, added a percentage point to close out 2022 with a 19% share.

Among the other five categories that were broken out, RTDs in fourth place and liqueurs in fifth also increased their shares by one percentage point each to 6% and 5% respectively. Drizly’s forecasts also included the growth of hard seltzer competitors and non-alcoholic drinks as well as the evolution of e-commerce.

Hits and misses

So which projections landed and which ones missed the mark?

- Hard seltzer’s competitors will see gains

Hit. Ready-to-drink beverages—one of hard seltzer’s main competitors—saw significant gains this year with the share of total Drizly sales growing year-on-year from 2% to 2.75%, driven by product innovation. Meanwhile, the hard seltzer category saw a year-over-year share decline from 3.8% in 2021 to 3.1% in 2022 year-to-date. Nevertheless, it remained larger than RTDs, though this could change in 2023. According to Drizly, the RTD category grew from 458 brands in 2021 to 570 in 2022, a 24% increase.”

- Consumers will expect more from e-commerce

Hit. E-commerce evolved its service elements in 2022 as competition heated up in the beverage alcohol space. “Consumer expectations increase when they are paying for delivery, particularly as inflation drives price sensitivity,” said Paquette, suggesting that this would fuel further service improvements. In Drizly’s 2022 Retail Report, 73% of respondents reported that shoppers are still willing to pay for the convenience of delivery, though 43% of retailers indicated that customers are purchasing slightly less-expensive spirits options than they would normally choose, a refection of the cost-of-living crisis.

- Tequila will challenge vodka as Drizly’s second-best selling spirit

Miss. Tequila did not challenge as such but it got closer to vodka through its one point share gain to 19% of the liquor category year-to-date. Meanwhile, vodka stayed flat at 23%. Liz Paquette, head of consumer insights at Drizly, commented: “Given tequila’s skyrocketing growth in 2021, its continued rise in 2022 remained impressive, especially relative to the overall size of the spirits category.” She was more surprised at vodka’s sustained share this year as retailer outlook for the category “remains underwhelming”.

- Non-alcoholic drinks will continue to grow

Hit. This category saw share gains across the three beverage categories of beer, wine, and spirits. Non-alcoholic drinks was among Drizly’s fastest-growing categories year-on-year in 2022 at 200%, with non-alcoholic spirits currently ranking as the platform’s fastest-growing sub-category versus the same time period in 2021. “Product innovation has been a key driver of the growth,” noted Paquette. “In 2022 to date there are over 120 non-alcoholic drinks brands in the Drizly catalogue, compared to 70 in the same time period in 2021.”

- Consumers will buy local

Hit. Due to post-Covid supply chain challenges there was an expectation that there would be a switch in demand to local wine, beer, and spirits. Based on in-house surveys, BevAlc Insights claims that nearly 65% of participants cited ‘locally made’ as the reason they intentionally stock certain products. This also reflects shoppers’ current desires to support local businesses.

- Gifting will stay strong

Hit. The gift share not only held strong in 2022 at 10% of total sales on Drizly, the average unit price for gift products increased. From $39.20 in 2021, average gift orders leapt to $46.80, during the same time period this year. That represents a 16% increase year-on-year. For comparison, the average unit price for standard orders in the past year was $18.80. Paquette commented: “Premiumisation was a driver of the average unit price growth as we saw consumers trade up for gifting. They opted for higher-end categories like Champagne, aged tequila, and Scotch, leading to higher price tags for their orders.” Rising prices from brand owners, especially spirits, would also have played their part.

Join us at SIAL Paris as exhibitor Join us at SIAL Paris as visitor