SOFT DRINKS PLAY CATCH-UP AMONG UK’S 150 BIGGEST F&B SUPPLIERS

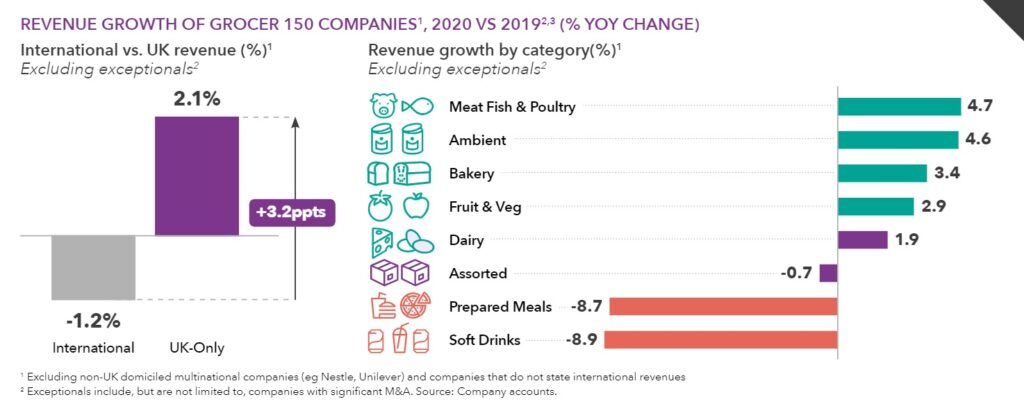

An in-depth analysis of the performance of the 150 largest soft drinks and food companies in the UK has found that 2020 was a year of low revenue growth and high-profit volatility in the sector. But the worst performing sector was soft drinks, down 8.9% while meat, fish and poultry was the best performing, up 4.7%.

Overall the industry largely absorbed the impact of the pandemic and there is a promising outlook – with some caveats. Primarily drinks or mixed groups that made the top 20 were milk/dairy brand Arla Foods (4th), Coca Cola (5th) both dropping one place each, and Britvic (15th) dropping two places.

Some of the other findings from the new Food & Drink 150 report from OC&C Strategy Consultants include:

- Profit margins remained robust in 2020, rising 0.3% year-on-year to 5.8%

- Larger brands demonstrated better ability to navigate Covid than smaller ones

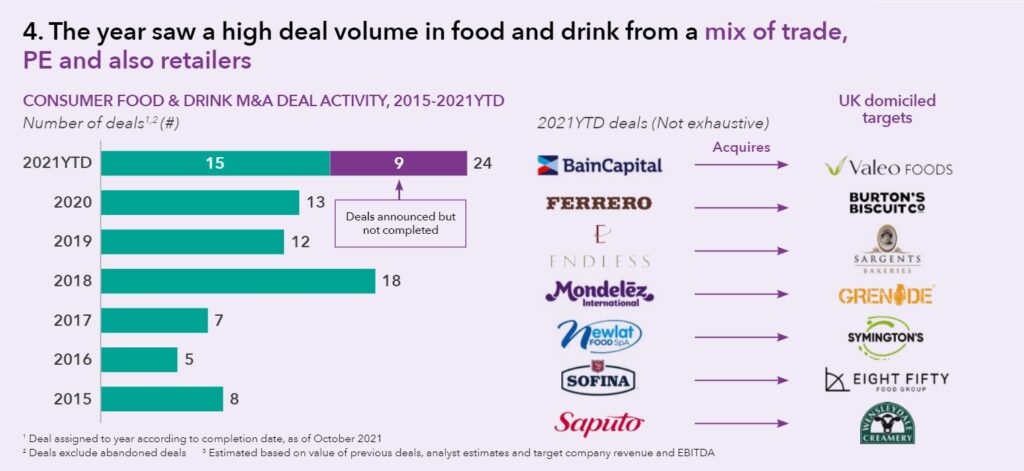

- A high volume of deals in 2020 (13) indicated the attractiveness of the sector and also the increasing influence of private equity (with 15 M&A deals struck in 2021 so far)

- ESG (environmental, social, and corporate governance) issue are more prominent than ever in external messaging in response to consumer demand for action on sustainability

- Challenges remain in future-proofing businesses as input costs rise and labour availability stays low.

Revenue down, margins up

While the biggest soft drinks and food producers saw a dip in revenue growth they mostly weathered the storm of Covid-19 in 2020. Overall revenue growth among top 150 F&B producers fell to 1.1%, down from almost 2% in 2019, though profit margins remained robust, rising to 5.8%, from 5.5% in 2019. Associated British Foods topped the ranking as the highest grossing food and drink producer for the second successive year.

The relatively stable figures masked volatility in both profits and revenue. Among the top 150, revenue for 26 companies grew by over 10%, while 20 saw declines of over 10% with larger brands able to better manage Covid-related disruption and cash in as other industries – such as hospitality and events – fell foul to Covid restrictions. Birds Eye, Weetabix and Valeo Foods were among those that saw the most improved margins.

Nilpesh Patel, Partner at OC&C commented: “The fortunes for the food and drink sector during 2020 can truly be classed as mixed. Scale allowed larger brands to better absorb the shockwaves of Covid, though smaller players and those more reliant on international sales struggled.

“However, the industry has bounced back well in 2021 with M&A activity buoyant and the sector clearly benefitting from private equity interest. This is despite labour shortages, increasing input costs and rising global inflation painting an uncertain picture.”

Deal-making in the sector was above average as 13 were completed in 2020, This year, 15 deals have been completed already, with a minimum of nine more expected. Most notable of the completions are Bain Capital’s acquisition of Valeo Foods and Mondelez’s acquisition of Grenade.

Among the companies that enjoyed a strong 12 months were the Eight Fifty Food Group, which after acquiring seafood producer Youngs in 2019 and expanding its product offer saw turnover climb 14.7%. The business has since been acquired by Canada’s Sofina Group.

Premier Foods, meanwhile, capitalised on consumers’ preference to stick with trusted brands during the pandemic and saw margins rise by 16.4%. Warburtons, Tilda and Albert Bartlett also enjoyed strong years thanks to product expansion and prioritising innovation.

Convenience shopping

The index also uncovered the extent to which consumers are now looking for convenience in their grocery shopping, a trend that the pandemic brought into keen focus. Year-on-year online channel sales rocketed from £11.6 billion in 2019 to £18 billion in 2020, with sales forecast to reach £22.6 billion in 2022 amid a new wave of rapid grocery delivery services such as Gorillas and Getir.

Patel said: “Convenience has taken on a new meaning, with consumer expectations in this area higher than ever. For legacy businesses, the next growth opportunity and challenge will be how effectively they can pivot to these more practical options for consumers. When it comes to sustainability, consumers are also voting with their feet. This trend is here to stay, and businesses must continue to enact changes within their governance structures and supply chains, otherwise, they risk being left behind.”

Join us at SIAL Paris as exhibitor Join us at SIAL Paris as visitor