US ORGANIC MARKET SALES TOPPED $63 BILLION IN 2021 AS STABILITY RETURNED

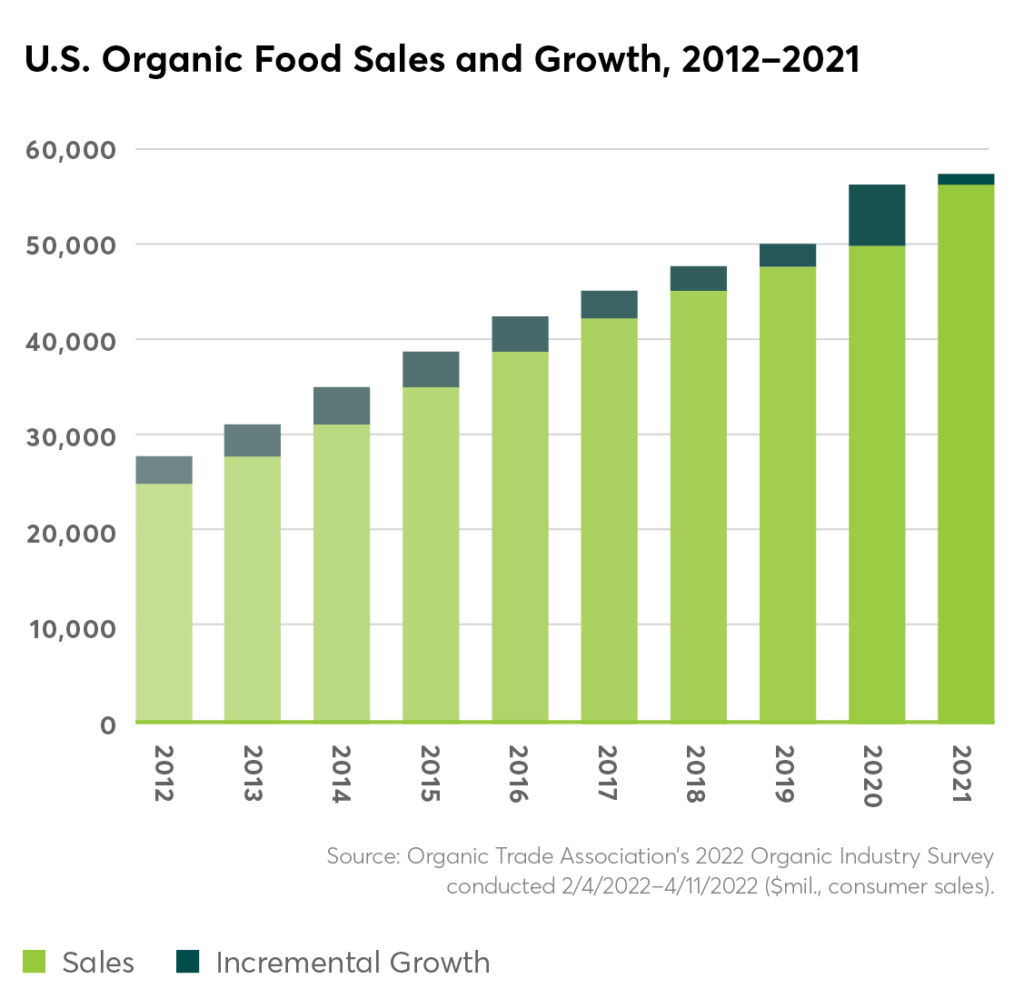

After a year of pandemic turmoil in 2020, last year proved to be more stable as US organic sales surpassed $63 billion, growing by 2% according to the latest annual industry survey data from the Organic Trade Association (OTA) which lobbies on behalf of stakeholders in the organic industry.

While food sales comprised over 90% of organic and wellness sales in 2021 at $57.5 billion, growing by 2%, it was the much smaller non-food segment that grew faster at 7% to reach $6 billion in sales.

The findings of the OTA’s latest survey suggest that consumers returned to more stable, buy-as-you-need shopping patterns last year, compared to the “pantry loading” driven by supply shortages seen in 2020.

The association’s CEO and executive director Tom Chapman said: “Like every other industry, the US organic business has been through many twists and turns over the last few years, but the industry’s resilience and creativity have kept us strong. In 2020, organic significantly increased its market foothold as Americans took a closer look at the products in their home and gravitated toward healthier choices.

“When pandemic purchasing habits and supply shortages began to ease in 2021, we saw the strongest performance from categories that were able to remain flexible, despite the shifting landscape. That ability to adapt and stay responsive to consumer and producer needs is a key part of US organic’s continued growth and success.”

The OTA’s US organic survey offers a valuable and detailed snapshot into purchasing habits across the country. Below are some of the key findings by sector.

Fruits and vegetables

Organic fruits and vegetables accounted for 15% of the total market, bringing in over $21 billion in revenue last year – an approximate 4.5% increase over 2020. Fresh produce and dried beans, fruits, and vegetables drove the growth at 6% and 6.5% respectively. Frozen and canned foods declined slightly as consumers stopped overstocking. In addition, packaging on produce increased because some shoppers perceived that it might better protect food from airborne viruses. This was a turnaround as, historically, organic food shoppers have preferred less packaging and plastic use.

Dairy, eggs, and meat

Staples like milk and eggs were among the first things to run out at the beginning of the pandemic as there was a scramble to stock them. In 2021, demand levelled off as supply caught up. Although US organic dairy and eggs sales remained relatively flat through 2021, the category still outperformed 2019 by nearly 11%. Meanwhile, organic poultry, seafood, and meat sales increased in 2021 by 2.5%, to nearly $2 billion. US organic poultry was the strongest performer, with 4.7 % growth to top $1 billion in sales.

The OTA says that US organic dairy, eggs, and meat “are likely to be further bolstered by the recently finalised Origin of Livestock (OOL) rule and the pending Organic Livestock Poultry Standards (OLPS) rule. “The OOL rule clarifies the standards for transitioning dairy livestock to organic milk production and will create a more level playing field for all organic dairy producers,” the OTA said.

Packaged/prepared foods and snacks

Packaged and prepared organic foods saw an overall decline of around 5% in 2021 after spikes a year earlier. Canned soups, nut butters, and pasta sauces had the largest decreases in 2021 while organic baby food was a bright spot with over 11% growth (to $1.2 billion in sales).

Snacks, the only organic category to contract in 2020, saw healthy growth of 6% to reach $3.3 billion in sales. This was helped by offices, gyms and schools reopening leading to more Americans looking for healthy foods on the go. Nutrition bars made the most headway, up 15% to over $1 billion in sales.

Beverages

Organic beverages achieved strong growth at 8% thanks to the category’s ability to remain nimble and adjust quickly to shifting consumer needs. As Americans increasingly transitioned into hybrid and work-from-home models, at-home coffee sales had a significant boost. Organic coffee saw more than 5% growth and over $2 billion in annual sales.

Breads and grains

Sales of organic breads and grains tapered off slightly in 2021 as the pandemic baking boom subsided, but sales were still strong at $6.2 billion. Frozen and fresh breads, the largest sub-category, saw a modest increase of 1.6% while baking ingredients, pastas, rice, and other dry grains declined. This category may continue to struggle as the war in Ukraine and other serious domestic and international issues constrain supply chains.

Non-food products

In this category, fibre, supplements, and personal care products were most dominant, with each generating growth of between 5.5% to 8.5% in 2021. Textiles, the largest non-food sub-category and representing 40% of the category’s total sales, brought in $2.3 billion. Overall, non-food products represented nearly $6 billion.

Chapman concluded: “US organic’s ability to retain market footholds gained during 2020, and to continue to grow – despite unprecedented challenges and uncertainty – is a testament to the strength of our industry. To keep organic strong, the industry will need to continue developing innovative solutions to supply chain weaknesses and prioritise efforts to engage and educate shoppers and businesses.”

Join us at SIAL Paris as exhibitor Join us at SIAL Paris as visitor