EASTERN EUROPE SPIRITS MARKET TO GROW AT 4% ANNUALLY TO 2026

The Eastern Europe spirits market was valued at $63.5 billion in 2021 across 20 countries and is projected to grow at a CAGR of more than 4% through to 2026 according to analysis from GlobalData.

The London-based consultancy said that, last year, Eastern Europe was the fourth-largest region for spirits, but that it would be the slowest growing alongside Western Europe until at least 2024 versus the Americas, Asia-Pacific, and Middle East & Africa regions.

Among the various categories in the sector – which include brandy; gin and genever; vodka; speciality spirits; whiskies; tequila and mezcal; liqueurs; rum; and flavoured alcoholic beverages – vodka accounted for the largest value share. In 2021, vodka was followed by brandy and speciality spirits. Spirits tends to include distilled alcoholic beverages with an alcohol content that typically ranges from 20% to 50% alcohol by volume.

Rum on a roll

When it comes to growth, one of the smaller categories in Eastern Europe – rum – is going to take the lead. “The rum category is expected to register the fastest value and volume CAGRs in the forecast period,” stated GlobalData.

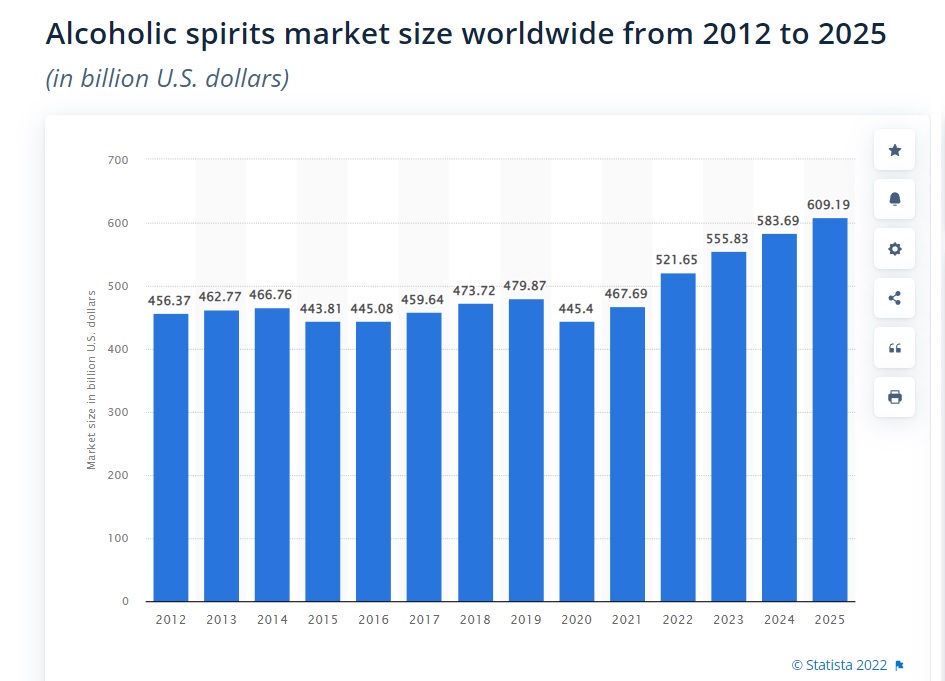

In its most recent analysis, another data analyst, Statista, noted that while there would be an Eastern European rebound after a big dip in 2022, it would be a gradual climb-back from 2023 to 2025 not a surge. The estimated slide this year reflects several factors, chief among them the Russia-Ukraine war and it is of a much bigger magnitude than the impact of Covid-19 in 2020.

The war, and the economic uncertainty it is has generated may be one reason that Statista’s future numbers are cautious; they indicate that by 2025, the spirits market will not grow much beyond the level of 2020 sales. Moreover, the lead category of vodka is not likely to show any dramatic bounce-back in revenue. By 2025, vodka sales are expected to stay significantly below 2019 levels.

According to the Statista data, the brandy and whisky segments are looking more resilient in the coming three years in terms of actual sales revenue. In terms of a rebound in growth, expect to see the biggest surges next year coming from gin and rum – in line with some of GlobaData’s findings above – with vodka trailing all other categories.

Central European markets lead

In its report, GlobaData noted that, based on the relative performance of various countries in the region – and applying multiple metrics – Poland, the Czech Republic, Latvia, and Hungary were identified as “high-potential countries”. This was mainly due to existing high demand for spirits, projected high-value growth rates, and rising per capita value growth.

Among these four former Soviet republics, Poland was the largest market from the perspective of both value and volume in 2021. The analyst did not reference the specific impact of the Russia-Ukraine war on either market.

In terms of distribution channels in the Eastern Europe spirits market,hypermarkets and supermarkets are comfortably ahead of food and drinks specialists, convenience stores, cash and carries and warehouse clubs, and the on-trade. This is not expected to change in the next few years. According to Statista, by 2025, 9% of spending and 5% of volume consumption in the spirits segment will be attributable to out-of-home consumption (such as in bars and restaurants) while the average volume consumption per person of spirits is expected to amount to 4.24 litres this year.

Leading companies and activities

Some major companies in the Eastern Europe spirits market include CEDC International; Global Spirits; Stock Spirits Group, the number two vodka player in Europe; Beluga Group; and Bayadera Group with CEDC International leading the sector in Eastern Europe in 2020, according to GlobalData. However, some major shifts have taken place since then, and particularly this year due to the Russia-Ukraine war.

Global giant Diageo, said in a June statement that it would withdraw its operations in Russia by the end of the year. Prior to that announcement in March, rival Pernod Ricard, together with Diageo, said they were “pausing” sales in the vast Russian market, where the French spirits group has been growing market share in recent years. At the end of April when reporting its nine-month sales ending March 2022, Pernod Ricard reported “excellent growth in Europe with some deceleration in March notably due to impacts of conflict in Ukraine”.

Join us at SIAL Paris as exhibitor Join us at SIAL Paris as visitor