IWSR: E-COMMERCE BEVERAGE ALCOHOL SALES TO SURGE 66% BY 2025, LED BY US

Thanks to its acceleration during the pandemic, the e-commerce channel for beverage alcohol drinks has come into its own in the past two years and is now a major source of wine and spirits sales in its own right. By 2025, e-commerce is projected to represent about 6% of all off-trade beverage alcohol volumes, compared to less than 2% in 2018, according to analyst IWSR.

Around one quarter of global alcohol consumers now say that they buy online. And by 2025, sales are expected to total over $42 billion across 16 key markets that the London-based research house considers to be the leaders in this channel.

For context, $42 billion is almost as large as the UK’s current total beverage alcohol market, highlighting the importance of this channel moving forward.

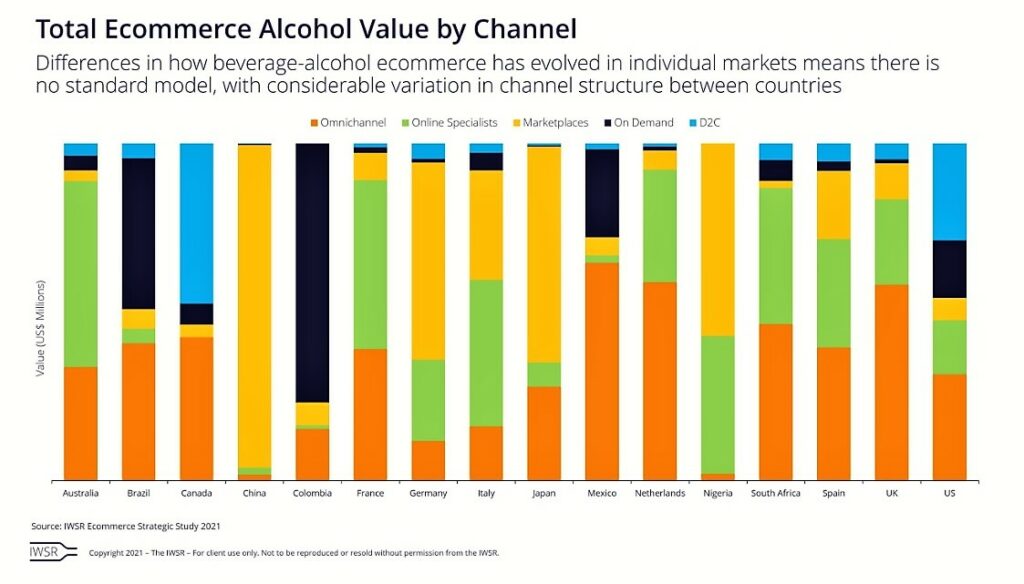

Among the 16 focus markets examined by IWSR (Australia, Brazil, Canada, China, Colombia, France, Germany, Italy, Japan, Mexico, Netherlands, Nigeria, South Africa, Spain, UK and US), e-commerce value increased by about 12% in 2019, and then by almost 43% in 2020 at the height of the pandemic.

The greatest e-commerce value growth will come from the US, which will see it become the top global market for online alcohol, overtaking China which currently accounts for a third of total e-commerce value. China is expected to expand less rapidly than the US.

IWSR discovers two overlapping worlds

Capturing spending in this channel could be a little tricky. Consumer research suggests that when it comes to buying alcohol online, there are two distinct but overlapping worlds: one based around traditional internet browsers and online ordering – generally favoured by older consumers seeking value; and the other, based around smartphone apps such as Drizly, favoured by younger shoppers who want convenience and novelty.

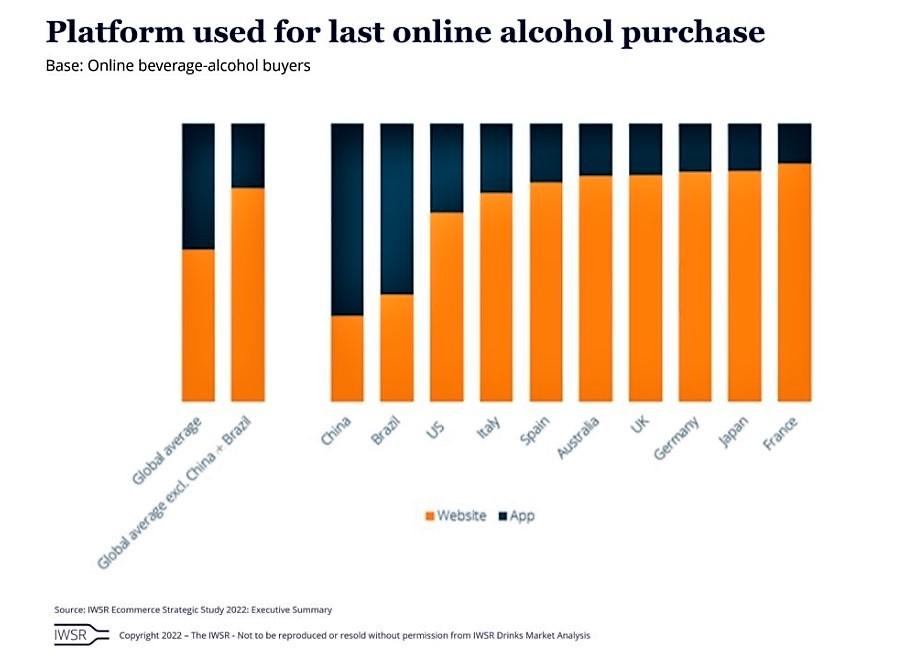

The purchasing platform is the most telling way in which these two worlds can be differentiated, but these vary substantially by country. IWSR says: “While consumers across all markets buy alcohol beverages through both websites and apps, there are significant variations by market. Websites are dominant overall, with 55% of consumers saying that they most recently used this type of platform. Website purchases generally skew towards the omnichannel and online specialist channels.”

Though the average is 55% in some markets it is much higher: France (86%), and Japan and the UK(83% each). But there are exceptions that brands need to be aware of. In China and Brazil, for example, consumers show a preference for apps, at 69% and 62% respectively. The US also has a relatively high number of app users, with 32% purchasing alcohol on their phones.

Apps galore

Higher app use often corresponds to a more fragmented market with a greater number of on-demand services. In Brazil, where many retailers lack their own delivery infrastructure, players like Colombia’s Rappi, James Delivery, and iFood are filling this gap by connecting consumers with a wide range of vendors, including alcoholic drinks sellers, and fast delivery.

On-demand services in the US also blossomed during the pandemic. They range from generalist apps such as Instacart and Fresh Direct grocery delivery (including alcohol) to dedicated players like Drizly (acquired by Uber for $1.1bn in 2021), and Minibar which partner with liquor stores and similar retailers.

In China, the story is different again. There, consumers commonly go to internet giants like JD.com, now expanding in Europe, and Tmall (owned by Alibaba) to access marketplaces offering a vast array of products, including alcohol. According to IWSR, they accounted for over 90% of total online alcohol sales in 2021 and many brands are opening flagship stores on these platforms to drive sales and increase brand awareness.

Understanding purchasing behaviour

In website-led markets, such as the UK, Japan, and France, buyers find the breadth of product range very important, says IWSR. They are also more likely to cite price as a key factor in purchase decision making. By contrast, consumers in app-driven markets have different preferences. While they are still influenced by special offers, price is less important than convenience and speed.

Guy Wolfe, strategic insights manager at IWSR, commented: “In countries where on-demand apps have become the leaders in alcohol e-commerce, shoppers have come to expect rapid delivery and are therefore extremely unwilling to give this up, even if it means a greater choice of products or lower delivery costs.”

He added: “But this works both ways. Where consumers primarily buy from omnichannel and online specialists that offer a strong product range and competitive prices, there is likely to be hesitance to adopt rapid delivery services if they come with a higher cost and/or narrower range of products.”

This demonstrates that consumer priorities are heavily influenced by their entry point to online and e-commerce and the kind of service to which they subsequently become accustomed.

Join us at SIAL Paris as exhibitor Join us at SIAL Paris as visitor